Tech

House-flipping algorithms are coming to your neighborhood

Published

2 years agoon

By

Terry Power

For years, Michael Maxson spent more nights in hotels than his own bed, working on speaker systems for the titans of heavy rock on global tours. When Maxson decided to settle down with his wife and their two dogs, they chose the city where stadium rock spectacles took him more often than any other: Las Vegas.

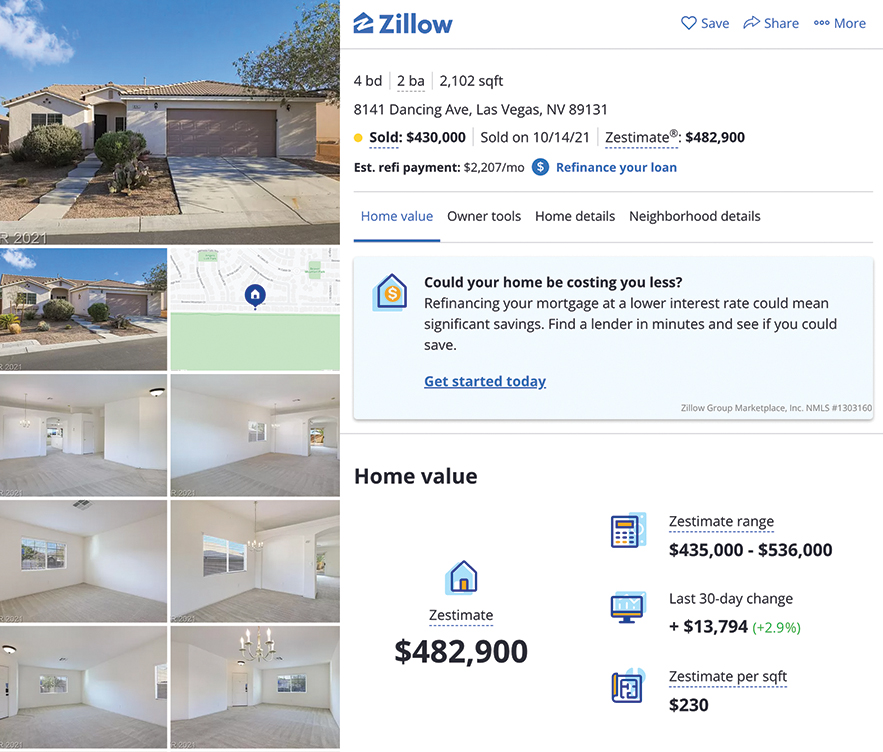

After renting for several years, in 2021 he found a home he wanted to buy in Clark County—a place within easy reach of Vegas’s headline venues yet also quiet, an airy single-story stucco house on Dancing Avenue, which backs onto a 2,000-acre park. He dreamed of waking up each morning to look out across lakes and parkland. “It was a beautiful home,” says Maxson. “I mean, the fact you could see the mountains and the sun set and rise. Man.”

But Maxson’s house hunt was unexpectedly chaotic. House prices in Las Vegas leaped up 25% that year, and the market was awash with cheap mortgages and wolfish investors.

His dream home was not owned by a person but by a tech company. Zillow, the US’s largest real estate listings site, had begun buying up homes in 2018, predicting it could create a “one-click nirvana” for purchasing real estate. It estimated returns of $20 billion a year. Zillow Offers, its “instant buying” business, followed startups like Opendoor and Offerpad, which had pioneered “iBuying,” the so-called “high-tech flipping” model, which uses data systems to price houses and investor cash to buy them before fixing them up and selling them.

In 2021, iBuyers’ purchases jumped to double prepandemic levels, accounting for tens of billions of dollars in home sales. Las Vegas was among the top 10 markets where startups concentrated their investments. In a feverish summer, Maxson had already been outmuscled on two bids by cash offers from Zillow and Opendoor. On Dancing Ave., Zillow now acted as seller, having listed the home on June 24 for $470,000, nearly $60,000 more than it had paid less than two weeks before. But Maxson wanted it and agreed to close at just under asking price.

When he went to take a look at the property, however, he discovered a 37,000-gallon water leak that had eroded garden walls and flooded the neighbors’ yard. Seattle-based Zillow, which owned the home, was oblivious, but the city authorities weren’t—Maxson found a notice stuck to the garage door, threatening a fine for allowing green water to pool, attracting mosquitos carrying West Nile virus. This is one downside of having homes owned by “faceless” corporations, says Maxson: “The [owners] were disconnected from it, because it’s just a number on a spreadsheet.” Though he offered to handle the estimated $30,000 of repairs himself, and take it off Zillow’s books for $30,000 less than the list price, they said no. Maxson discovered soon after that the house had sold to another family, at the same price he had offered. He estimates that he lost about $2,000 on inspections and other costs—the closest he came to securing a home in 22 attempts that summer.

But at the very same time, the startup that had profited from his dream home was discovering cracks in its own foundation. As it turned out, Zillow Offers had lost more than $420 million in three months of erratic house buying and unprofitable sales. As Zillow Offers shut down, analysts questioned whether other iBuyers were at risk or whether the entire tech-driven model is even viable. For the rest of us—neighbors, renters, or prospective buyers—the bigger question remains: Does the arrival of Silicon Valley tech point to a better future for housing or an industry disruption to fear?

Dogfight

By summer 2021, the US housing market had almost run out of records to break. The Washington Post reported house prices at all-time highs (with a median of $386,000 in June) as the number of homes listed hit record lows (1.38 million nationwide). The average home sold in 15 days that summer—half the time taken a year earlier—as cash-rich investors and second-home buyers bought more than ever before. By November, a New York Times headline asked: “Will Real Estate Ever Be Normal Again?”

Despite making just under 2% of home purchases nationwide during this period, iBuyers began to play a larger, and more unpredictable, role than most, leading to calls from city leaders in Los Angeles to ban the platforms. iBuyers grow city by city; investment is tightly concentrated in a handful of locations across the Sun Belt, where the top five—Phoenix, Atlanta, Dallas, Charlotte, and Houston—accounted for more than half the total activity. Through 2021, iBuyers bought 70,400 houses nationwide. Nascent iBuyers are raising fundraising rounds in the United Kingdom, Europe, and Canada—but all are looking to the successes and failures of the stateside front-runners.

These cities form a neat growth pattern, following a “strikingly similar” trend to one seen in the trailblazer, Phoenix, according to the National Bureau of Economic Research (NBER), which analyzed iBuying by Zillow, Opendoor, Knock, Redfin, and Offerpad between 2013 and 2018. iBuyers had roughly 1% market share in Phoenix in 2015, growing to 6% in 2018. In the frantic summer of 2021, iBuyers accounted for 10% of home buys in Phoenix. “In certain neighborhoods, 25 to 30% of current listings right now are owned by iBuyers,” says real estate tech strategist Mike DelPrete.

Today Opendoor, the market leader, is operating in 44 markets. iBuyers are intervening in super-hot housing markets by harnessing big data and artificial intelligence to create a one-sided advantage over regular folks. Where house buying was once a “dogfight” between individuals, “now we’re in the age of guided missiles,” says DelPrete, with data-driven buyers claiming a big edge.

Real estate tech startups started digitizing processes that have “been pen-and-paper for centuries.”

Zach Aarons

There is, obviously, a lot of money tied up in real estate. Residential real estate remains the main asset that American families possess, accounting for about 70% of median household wealth. Over 2021, the value of US housing stock jumped by $7 trillion, hitting $43.4 trillion total.

Real estate transactions have long been considered ripe for disruption because buying or selling a house is time consuming, confusing, and laden with hidden expenses. Yet residential real estate has been slow to innovate—it’s the “largest, undisrupted market in the US,” according to Opendoor.

When it comes to buying and selling, real-estate tech—or “proptech”—is changing three things, says Zach Aarons, cofounder of venture capital firm MetaProp. “One, it can showcase listings,” says Aarons, calling back to Zillow’s initial success as a one-stop shop for seeing what’s on the market. Second, startups started digitizing time-consuming processes that have “fundamentally been pen-and-paper for centuries.”

“How do we deliver a title policy with more transparency, more accountability, quicker timing?” he asks. “How do we have e-closing, e-notarization? I think the pandemic accelerated a lot of that.”

The third matter, valuations, remains by far the thorniest. Automated valuation models (AVMs) are proprietary data systems that take in sales prices from the US’s 600 multiple listings services—the real estate agent’s bread-and-butter data—and combine them with information from mortgage lenders, public data sets, and map data like Yelp reviews of local bars, plus private data sold by real estate analysts. First-party data is increasingly accumulated, too: Opendoor created an app for in-person inspectors, pre-covid, with a 100-point checklist, while today, sellers perform self-service virtual assessments.

Opendoor’s tech chief, Ian Wong, says the foundation of their work is data cleansing—taking partial, duplicated, and contradictory data and parsing it to produce reliable insights. But “human-in-the-loop” systems remain vital, he says. The company has real people annotate visual data, adding labels in a manner he likens to the processing done on crowdsourced platforms similar to Mechanical Turk.

One goal of this data work is to eliminate the so-called “lemons problem.” So far, AVMs have been able to access only a portion of the information that a family selling its home knows, explains Amit Seru, a professor of finance at the Stanford Graduate School of Business—failing to appreciate architectural style, unruly neighbors, how light hits the porch on late summer evenings, and myriad qualities contributing to a house’s human appeal. Consequently, these AVMs can lead iBuyers to disaster when some sellers offer up “lemons” (dud homes, say, with stinking carpets) and others offer “peaches” (a charming home in a neighborhood full of amenities). By bidding an average price for both homes, the iBuyer ends up paying too much for lemons, while families with peaches—who feel harshly undervalued—refuse to sell.

Wong says that both deep learning and humans can help minimize such issues by, say, analyzing photos for defects like ugly power lines cutting across the yard. AVM advances have expanded Opendoor’s “buy box,” the subset of homes it can purchase, since its launch in Phoenix in 2014. iBuyers typically start buying cookie-cutter houses, priced between $100,000 and $250,000, that are relatively new and on modest-sized lots, according to research out of Stanford, Northwestern, and Columbia. In February, Opendoor explained that it had grown its buy box by 50%. “Today we are doing higher-price-point homes. We’re going to gated communities, age-restricted communities, things that are harder to price,” says Wong. “And we’ve been able to expand all the way to Atlanta … to the most recent market we announced, which is the San Francisco Bay Area, which has very heterogeneous housing types.”

But how effective has this valuation technology actually been? Zillow has revealed that it lost $881 million on Zillow Offers. In a letter to shareholders, CEO Rich Barton explained that the venture was “too risky, too volatile to our earnings and operations”; it provided “too low of a return on equity opportunity, and too narrow in its ability to serve our customers.” The pivot forced the company to lay off 25% of its staff and left it facing two class action lawsuits from shareholders. Other iBuyers have a better record of profiting from sales yet are losing money overall, with Opendoor reporting a net loss of $662 million for 2021, its shares falling as measures of profitability were cut. The company, though, is bullish on growth, predicting a 460% increase in revenue in the first quarter of 2022 compared to one year ago. “In short, Zillow is out of the game, but Opendoor is getting bigger and stronger,” says DelPrete.

Database: America

Zillow’s pricing failures wiped out more than $35 billion in market value by February 2022. For buyers like him, Maxson says, “It’s insane! They’re falsifying the market.” Despite concert tours torpedoed by covid, Maxson says, he’s lucky to have kept earning a living, but he fears his neighbors will struggle: “A blackjack dealer and the husband does maintenance at the MGM [casino] … How do they try to navigate this if they want to buy a house?”

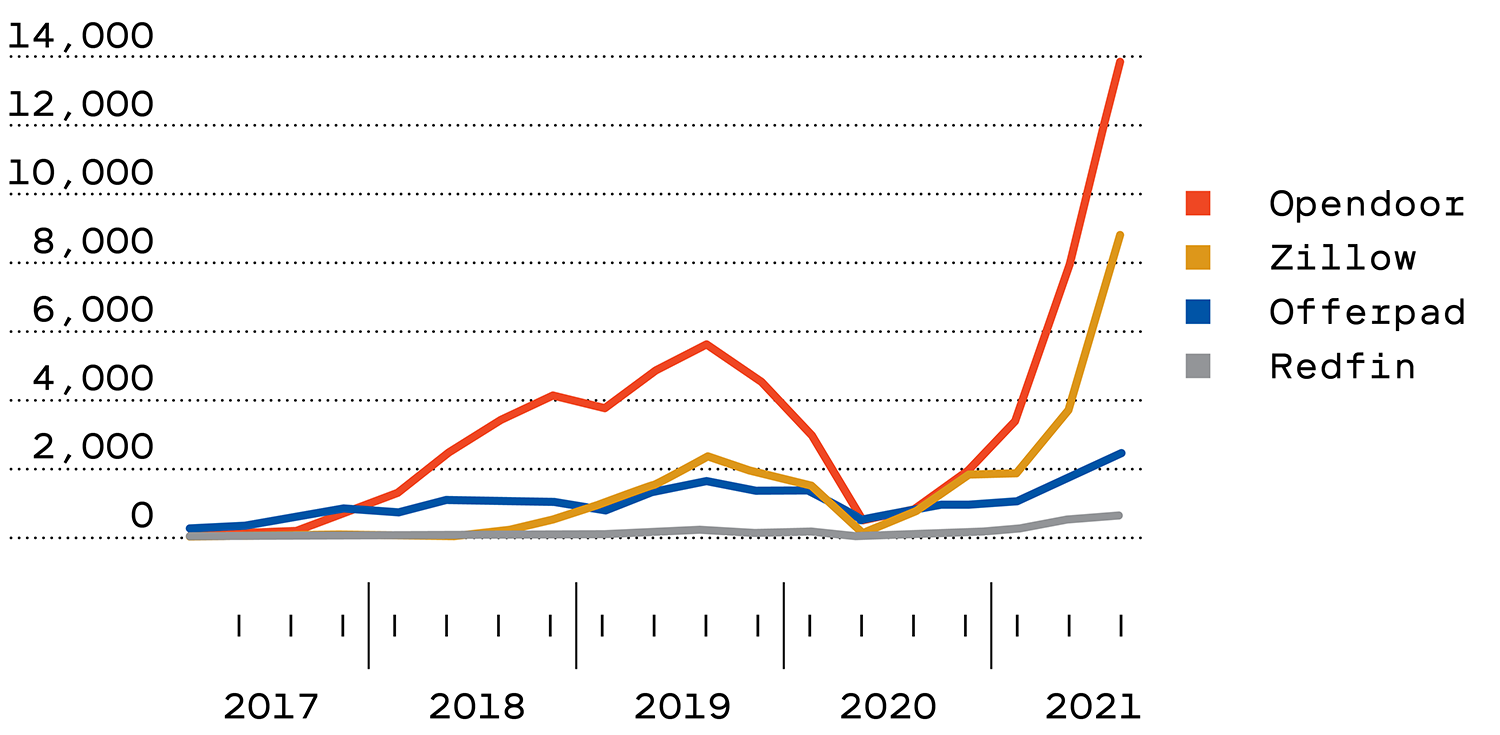

iBuyer purchases increased significantly in 2021

Making sense of iBuyers’ erratic transactions means understanding not just how their technology works, but where they come from, explains DelPrete. Tech-led disruption of real estate is not the result of a couple of buddies in a garage, he explains: “There are no pure tech plays that are revolutionizing real estate.” The fuel is billions of dollars that investment firms are pouring into housing, with Opendoor backed by $400 million from SoftBank, among other giants. The upheaval Maxson witnessed is one “downside of having a for-profit Wall Street–funded corporate middleman involved in the real estate transaction,” says DelPrete. “The company’s winning. Somebody has to lose.” But the impact is also felt by consumers, neighborhoods, and cities.

iBuyers’ primary benefit is supplying liquidity to a market where transactions are onerous. For a busy family, selling to an iBuyer can cut the need for presale repairs and viewings. For someone offered a new job in a faraway city, it can mean saying yes to relocating right away. Thousands of sellers have been willing to take an average $9,000 discount for this speed and simplicity, according to the NBER working paper. iBuyers’ arrival in new cities gives consumers extra options, offering fair bids and often lower agency fees than conventional agents, says DelPrete.

“The company’s winning. Somebody has to lose.”

Mike DelPrete

Drew Meyers, founder of Geek Estate, a private and paid community of more than 500 proptech executives and a Zillow alum, says it’s crucial to see iBuyers in the context of other proptech innovation, which also includes “power buyer” startups that allow homeowners to “buy before they sell.” VC investment and cheap debt are key here, too: “Most of the innovation is finance-driven, frankly,” says Meyers. “A lot of these companies are disguised as real estate companies, but they’re really fintech plays.”

One clear example, investment marketplace Roofstock, provides a platform that has helped investors put $5 billion into buying single-family homes to flip into rentals, often without a buyer ever entering the home. Roofstock compares prices, rental yields, and risk, giving a one- to five-star “neighborhood rating” based on factors like school districts and rates of employment. “We built a database of all roughly 90 million homes in the US, where we started with tax and deed information and then augmented it with ownership information, rents (if it’s a rental), evaluation information, all that,” says Gary Beasley, Roofstock’s CEO. “So we have this living, breathing database of every single-family house in America. And we overlay our neighborhood scores and transactional data, and really have a view on what every home is worth as an investment, right?”

!function(){“use strict”;window.addEventListener(“message”,(function(e){if(void 0!==e.data[“datawrapper-height”]){var t=document.querySelectorAll(“iframe”);for(var a in e.data[“datawrapper-height”])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Today investors buy 27% of single-family homes in the US. Four in 10 are bought by small-scale investors owning fewer than 10 homes—who may buy in their home neighborhood or use tools like Roofstock. These buy-to-rent purchases are today a lightning rod for criticism, with investors outmuscling first-time buyers for scarce starter homes and reducing the number of affordable homes later sold. By “equity-mining” neighborhoods where families could once build wealth, investors instead capture the uplift themselves.

Dashboards like Roofstock’s are the mostly unseen war rooms in America’s housing chaos, helping faraway speculators make big returns while playing havoc withthe lives of people on the ground. In interviews with startups as well as real estate agents and analysts, it emerges that when a family finds its dream home, it has often already been crawled by AVMs that have analyzed its value as an asset, its potential yield as a rental, its forecast price growth, and countless other metrics.

Wall Street elite

Some of the world’s biggest real estate investors are guided by in-house systems that remain black boxes—and whose insights are fiercely guarded in Wall Street towers.

Private equity giants like Blackstone and Starwood Capital bought foreclosed homes in the aftermath of the subprime crash in 2008, bundling them into single-family rental empires, including Invitation Homes and Starwood Waypoint. These merged in 2017 to create the US’s largest single-family landlord, with a portfolio of 82,000 homes. Again, as in the subprime crisis, homes were transformed into tradeable asset classes worth billions. Cloud-based property management technologies underpinned these landlords, explains Steve Weikal, real estate tech lead at the MIT Real Estate Innovation Lab. These allowed firms to manage everything—from rent collection to home maintenance—in geographically dispersed homes, as easily as corporations had managed apartment buildings. Bigger tools followed, like Blackstone’s Real Estate Data Direct, which since 2021 has pooled data from hundreds of companies it owns while amassing the world’s largest portfolio of commercial real estate, now valued at $514 billion.

To support MIT Technology Review’s journalism, please consider becoming a subscriber.

Many Wall Street pioneers sold their rental businesses in the decade after the crash, making billions for investors and executives but leaving a trail of anger from tenants who endured poor maintenance and rent hikes. Yet coming into the pandemic, Wall Street had again assembled an unimaginable arsenal with which to strike deals—around $2.3 trillion. It was preparing, suggested the Wall Street Journal, “for what could be a once-in-a-generation opportunity to buy distressed real-estate assets at bargain prices.”

These firms are reinvesting in a big way. Blackstone bought Home Partners of America, with 17,000 homes, for $6 billion in June 2021. Toronto-based Tricon launched a $5 billion joint venture in July to buy up 18,000 homes across the Sun Belt. Indeed, many proptech innovations were developed by these Wall Street giants, with Blackstone alumni leading disruption from VC firm Fifth Wall and European pioneer IMMO. Roofstock founder Beasley was co-CEO of Starwood Waypoint Residential Trust, one of the US’s largest single-family rental companies, and sees his startup as disseminating the same tech tools. “The idea with Roofstock really was to take a lot of that knowledge of how we could package up and sell and manage single-family rentals, and offer that as a service both to institutional investors as well as individual investors,” says Beasley.

“That’s 7,000 families that didn’t have a chance to buy a home.”

Mike DelPrete

But links between Wall Street and proptech go further. A Bloomberg investigation found a “secret pipeline” of sales from iBuyers to big investors accounting for one in five homes they sold. The rate is double that, around 40%, in some Sun Belt metro areas, with many sold off-market. “That’s a big issue,” says DelPrete. “If that was 7,000 transactions, that’s 7,000 families that didn’t have a chance to buy a home just because a company decided not to list houses for sale.”

Fighting back

Last October, Los Angeles city council members Nithya Raman and Nury Martinez sounded the alarm that startups and Wall Street threatened to put an end to the American Dream. “It shouldn’t be impossible for Angelenos to remain in the neighborhood they grew up in or for hardworking families to purchase their first home,” says Martinez. “Angelenos just can’t compete with the money and power of iBuyers.”

In a motion, they instructed the city’s legal departments to seek ways to limit such speculative practices in order to rebalance the playing field. California had already restricted its SB9 law (which allows homeowners to develop another property on their lot) to those who commit to living on-site for three years, explained Meyers, to exclude corporate landlords. Maxson, who eventually found a home with the help of a regular, human agent, agrees with the move: “I think they need to be regulated. They’re taking a problem in the United States and making it worse.”

But some caution against clamping down on disruption. In a market ingrained with a history of racist practices—and where the appraisal industry remains 84% white—AVMs can mean fairer deals for minorities, explains Lauren Rhue, an assistant professor at the University of Maryland.

A landmark study in September confirmed anecdotal evidence of an “appraisal gap,” showing that homes in Black and Latino neighborhoods are consistently undervalued. Freddie Mac analyzed more than 12 million mortgage records between 2015 and 2020 and found that in Latino neighborhoods appraisers were twice as likely to value homes below the eventual sale price, with similar outcomes in Black neighborhoods.

Rhue is concerned that “what you could see is just a perpetuation of the issues that we’ve had historically in this country with housing.” Indeed, machine learning can entrench problems when fed data influenced by decades of discrimination. Home values—which are 55% lower in majority Black census tracts, on average, than in white areas—are a prime example.

A viral TikTok video by Nevada-based real estate agent Sean Gotcher made headlines in September by demonstrating how iBuyers might attempt to manipulate prices. “Let’s say that that company buys 30 homes within a two-mile radius, and let’s say the price is $300,000,” Gotcher explained. “Then on the 31st home, they buy it for $340.” Although overpaying, this new “comp” means they have a benchmark to sell the rest at $340,000.

Most analysts agreed that iBuyers are not big enough to pull this off. That would mean owning a big share of the local market, and restricting supply to drive sale prices up. But there are already signs big investors are restricting supply, further exacerbating housing crises and setting a template that any big iBuyer could follow. New York corporate landlords “warehoused” up to 50% of homes during the first covid-19 lockdown—keeping them empty to restrict free-falling rents. On a smaller scale, Opendoor continued buying homes in the winter of 2020, but curiously stopped listing them for sale.

For ordinary people, so long as Wall Street cash is flowing into housing, Zillow’s failure is not the end of tech-led disruption but a fumbled beginning. “iBuying, power buying, co-investments, down payment assistance, cash offers,” says Meyers. “They’re all going to end up doing it all.” Each company is now trying to capture and automate more of the value of the transaction chain that has traditionally been split between mortgage brokers, flippers, title agents, real estate agents, and more. The core mechanics—tech to value homes and manage deals, married with free-flowing finance—give entrepreneurs room to reinvent the offer. Some innovations may be boons for prospective home buyers. But just as surely, others will empower the most cut-throat investors in the world.

Matthew Ponsford is a freelance reporter based in London.

You may like

-

The Download: inaccurate welfare algorithms, and training AI for free

-

A Cambridge Analytica-style scandal for AI is coming

-

OpenAI’s hunger for data is coming back to bite it

-

Bacteria can be engineered to fight cancer in mice. Human trials are coming.

-

Understanding the ethics of algorithms, AI, and automation with holistic AI

-

Mpox Could Resurge In Coming Months, CDC Warns

My senior spring in high school, I decided to defer my MIT enrollment by a year. I had always planned to take a gap year, but after receiving the silver tube in the mail and seeing all my college-bound friends plan out their classes and dorm decor, I got cold feet. Every time I mentioned my plans, I was met with questions like “But what about school?” and “MIT is cool with this?”

Yeah. MIT totally is. Postponing your MIT start date is as simple as clicking a checkbox.

COURTESY PHOTO

Now, having finished my first year of classes, I’m really grateful that I stuck with my decision to delay MIT, as I realized that having a full year of unstructured time is a gift. I could let my creative juices run. Pick up hobbies for fun. Do cool things like work at an AI startup and teach myself how to create latte art. My favorite part of the year, however, was backpacking across Europe. I traveled through Austria, Slovakia, Russia, Spain, France, the UK, Greece, Italy, Germany, Poland, Romania, and Hungary.

Moreover, despite my fear that I’d be losing a valuable year, traveling turned out to be the most productive thing I could have done with my time. I got to explore different cultures, meet new people from all over the world, and gain unique perspectives that I couldn’t have gotten otherwise. My travels throughout Europe allowed me to leave my comfort zone and expand my understanding of the greater human experience.

“In Iceland there’s less focus on hustle culture, and this relaxed approach to work-life balance ends up fostering creativity. This was a wild revelation to a bunch of MIT students.”

When I became a full-time student last fall, I realized that StartLabs, the premier undergraduate entrepreneurship club on campus, gives MIT undergrads a similar opportunity to expand their horizons and experience new things. I immediately signed up. At StartLabs, we host fireside chats and ideathons throughout the year. But our flagship event is our annual TechTrek over spring break. In previous years, StartLabs has gone on TechTrek trips to Germany, Switzerland, and Israel. On these fully funded trips, StartLabs members have visited and collaborated with industry leaders, incubators, startups, and academic institutions. They take these treks both to connect with the global startup sphere and to build closer relationships within the club itself.

Most important, however, the process of organizing the TechTrek is itself an expedited introduction to entrepreneurship. The trip is entirely planned by StartLabs members; we figure out travel logistics, find sponsors, and then discover ways to optimize our funding.

COURTESY PHOTO

In organizing this year’s trip to Iceland, we had to learn how to delegate roles to all the planners and how to maintain morale when making this trip a reality seemed to be an impossible task. We woke up extra early to take 6 a.m. calls with Icelandic founders and sponsors. We came up with options for different levels of sponsorship, used pattern recognition to deduce the email addresses of hundreds of potential contacts at organizations we wanted to visit, and all got scrappy with utilizing our LinkedIn connections.

And as any good entrepreneur must, we had to learn how to be lean and maximize our resources. To stretch our food budget, we planned all our incubator and company visits around lunchtime in hopes of getting fed, played human Tetris as we fit 16 people into a six-person Airbnb, and emailed grocery stores to get their nearly expired foods for a discount. We even made a deal with the local bus company to give us free tickets in exchange for a story post on our Instagram account.

Tech

The Download: spying keyboard software, and why boring AI is best

Published

8 months agoon

22 August 2023By

Terry Power

This is today’s edition of The Download, our weekday newsletter that provides a daily dose of what’s going on in the world of technology.

How ubiquitous keyboard software puts hundreds of millions of Chinese users at risk

For millions of Chinese people, the first software they download onto devices is always the same: a keyboard app. Yet few of them are aware that it may make everything they type vulnerable to spying eyes.

QWERTY keyboards are inefficient as many Chinese characters share the same latinized spelling. As a result, many switch to smart, localized keyboard apps to save time and frustration. Today, over 800 million Chinese people use third-party keyboard apps on their PCs, laptops, and mobile phones.

But a recent report by the Citizen Lab, a University of Toronto–affiliated research group, revealed that Sogou, one of the most popular Chinese keyboard apps, had a massive security loophole. Read the full story.

—Zeyi Yang

Why we should all be rooting for boring AI

Earlier this month, the US Department of Defense announced it is setting up a Generative AI Task Force, aimed at “analyzing and integrating” AI tools such as large language models across the department. It hopes they could improve intelligence and operational planning.

But those might not be the right use cases, writes our senior AI reporter Melissa Heikkila. Generative AI tools, such as language models, are glitchy and unpredictable, and they make things up. They also have massive security vulnerabilities, privacy problems, and deeply ingrained biases.

Applying these technologies in high-stakes settings could lead to deadly accidents where it’s unclear who or what should be held responsible, or even why the problem occurred. The DoD’s best bet is to apply generative AI to more mundane things like Excel, email, or word processing. Read the full story.

This story is from The Algorithm, Melissa’s weekly newsletter giving you the inside track on all things AI. Sign up to receive it in your inbox every Monday.

The ice cores that will let us look 1.5 million years into the past

To better understand the role atmospheric carbon dioxide plays in Earth’s climate cycles, scientists have long turned to ice cores drilled in Antarctica, where snow layers accumulate and compact over hundreds of thousands of years, trapping samples of ancient air in a lattice of bubbles that serve as tiny time capsules.

By analyzing those cores, scientists can connect greenhouse-gas concentrations with temperatures going back 800,000 years. Now, a new European-led initiative hopes to eventually retrieve the oldest core yet, dating back 1.5 million years. But that impressive feat is still only the first step. Once they’ve done that, they’ll have to figure out how they’re going to extract the air from the ice. Read the full story.

—Christian Elliott

This story is from the latest edition of our print magazine, set to go live tomorrow. Subscribe today for as low as $8/month to ensure you receive full access to the new Ethics issue and in-depth stories on experimental drugs, AI assisted warfare, microfinance, and more.

The must-reads

I’ve combed the internet to find you today’s most fun/important/scary/fascinating stories about technology.

1 How AI got dragged into the culture wars

Fears about ‘woke’ AI fundamentally misunderstand how it works. Yet they’re gaining traction. (The Guardian)

+ Why it’s impossible to build an unbiased AI language model. (MIT Technology Review)

2 Researchers are racing to understand a new coronavirus variant

It’s unlikely to be cause for concern, but it shows this virus still has plenty of tricks up its sleeve. (Nature)

+ Covid hasn’t entirely gone away—here’s where we stand. (MIT Technology Review)

+ Why we can’t afford to stop monitoring it. (Ars Technica)

3 How Hilary became such a monster storm

Much of it is down to unusually hot sea surface temperatures. (Wired $)

+ The era of simultaneous climate disasters is here to stay. (Axios)

+ People are donning cooling vests so they can work through the heat. (Wired $)

4 Brain privacy is set to become important

Scientists are getting better at decoding our brain data. It’s surely only a matter of time before others want a peek. (The Atlantic $)

+ How your brain data could be used against you. (MIT Technology Review)

5 How Nvidia built such a big competitive advantage in AI chips

Today it accounts for 70% of all AI chip sales—and an even greater share for training generative models. (NYT $)

+ The chips it’s selling to China are less effective due to US export controls. (Ars Technica)

+ These simple design rules could turn the chip industry on its head. (MIT Technology Review)

6 Inside the complex world of dissociative identity disorder on TikTok

Reducing stigma is great, but doctors fear people are self-diagnosing or even imitating the disorder. (The Verge)

7 What TikTok might have to give up to keep operating in the US

This shows just how hollow the authorities’ purported data-collection concerns really are. (Forbes)

8 Soldiers in Ukraine are playing World of Tanks on their phones

It’s eerily similar to the war they are themselves fighting, but they say it helps them to dissociate from the horror. (NYT $)

9 Conspiracy theorists are sharing mad ideas on what causes wildfires

But it’s all just a convoluted way to try to avoid having to tackle climate change. (Slate $)

10 Christie’s accidentally leaked the location of tons of valuable art

Seemingly thanks to the metadata that often automatically attaches to smartphone photos. (WP $)

Quote of the day

“Is it going to take people dying for something to move forward?”

—An anonymous air traffic controller warns that staffing shortages in their industry, plus other factors, are starting to threaten passenger safety, the New York Times reports.

The big story

Inside effective altruism, where the far future counts a lot more than the present

October 2022

Since its birth in the late 2000s, effective altruism has aimed to answer the question “How can those with means have the most impact on the world in a quantifiable way?”—and supplied methods for calculating the answer.

It’s no surprise that effective altruisms’ ideas have long faced criticism for reflecting white Western saviorism, alongside an avoidance of structural problems in favor of abstract math. And as believers pour even greater amounts of money into the movement’s increasingly sci-fi ideals, such charges are only intensifying. Read the full story.

—Rebecca Ackermann

We can still have nice things

A place for comfort, fun and distraction in these weird times. (Got any ideas? Drop me a line or tweet ’em at me.)

+ Watch Andrew Scott’s electrifying reading of the 1965 commencement address ‘Choose One of Five’ by Edith Sampson.

+ Here’s how Metallica makes sure its live performances ROCK. ($)

+ Cannot deal with this utterly ludicrous wooden vehicle.

+ Learn about a weird and wonderful new instrument called a harpejji.

Tech

Why we should all be rooting for boring AI

Published

8 months agoon

22 August 2023By

Terry Power

This story originally appeared in The Algorithm, our weekly newsletter on AI. To get stories like this in your inbox first, sign up here.

I’m back from a wholesome week off picking blueberries in a forest. So this story we published last week about the messy ethics of AI in warfare is just the antidote, bringing my blood pressure right back up again.

Arthur Holland Michel does a great job looking at the complicated and nuanced ethical questions around warfare and the military’s increasing use of artificial-intelligence tools. There are myriad ways AI could fail catastrophically or be abused in conflict situations, and there don’t seem to be any real rules constraining it yet. Holland Michel’s story illustrates how little there is to hold people accountable when things go wrong.

Last year I wrote about how the war in Ukraine kick-started a new boom in business for defense AI startups. The latest hype cycle has only added to that, as companies—and now the military too—race to embed generative AI in products and services.

Earlier this month, the US Department of Defense announced it is setting up a Generative AI Task Force, aimed at “analyzing and integrating” AI tools such as large language models across the department.

The department sees tons of potential to “improve intelligence, operational planning, and administrative and business processes.”

But Holland Michel’s story highlights why the first two use cases might be a bad idea. Generative AI tools, such as language models, are glitchy and unpredictable, and they make things up. They also have massive security vulnerabilities, privacy problems, and deeply ingrained biases.

Applying these technologies in high-stakes settings could lead to deadly accidents where it’s unclear who or what should be held responsible, or even why the problem occurred. Everyone agrees that humans should make the final call, but that is made harder by technology that acts unpredictably, especially in fast-moving conflict situations.

Some worry that the people lowest on the hierarchy will pay the highest price when things go wrong: “In the event of an accident—regardless of whether the human was wrong, the computer was wrong, or they were wrong together—the person who made the ‘decision’ will absorb the blame and protect everyone else along the chain of command from the full impact of accountability,” Holland Michel writes.

The only ones who seem likely to face no consequences when AI fails in war are the companies supplying the technology.

It helps companies when the rules the US has set to govern AI in warfare are mere recommendations, not laws. That makes it really hard to hold anyone accountable. Even the AI Act, the EU’s sweeping upcoming regulation for high-risk AI systems, exempts military uses, which arguably are the highest-risk applications of them all.

While everyone is looking for exciting new uses for generative AI, I personally can’t wait for it to become boring.

Amid early signs that people are starting to lose interest in the technology, companies might find that these sorts of tools are better suited for mundane, low-risk applications than solving humanity’s biggest problems.

Applying AI in, for example, productivity software such as Excel, email, or word processing might not be the sexiest idea, but compared to warfare it’s a relatively low-stakes application, and simple enough to have the potential to actually work as advertised. It could help us do the tedious bits of our jobs faster and better.

Boring AI is unlikely to break as easily and, most important, won’t kill anyone. Hopefully, soon we’ll forget we’re interacting with AI at all. (It wasn’t that long ago when machine translation was an exciting new thing in AI. Now most people don’t even think about its role in powering Google Translate.)

That’s why I’m more confident that organizations like the DoD will find success applying generative AI in administrative and business processes.

Boring AI is not morally complex. It’s not magic. But it works.

Deeper Learning

AI isn’t great at decoding human emotions. So why are regulators targeting the tech?

Amid all the chatter about ChatGPT, artificial general intelligence, and the prospect of robots taking people’s jobs, regulators in the EU and the US have been ramping up warnings against AI and emotion recognition. Emotion recognition is the attempt to identify a person’s feelings or state of mind using AI analysis of video, facial images, or audio recordings.

But why is this a top concern? Western regulators are particularly concerned about China’s use of the technology, and its potential to enable social control. And there’s also evidence that it simply does not work properly. Tate Ryan-Mosley dissected the thorny questions around the technology in last week’s edition of The Technocrat, our weekly newsletter on tech policy.

Bits and Bytes

Meta is preparing to launch free code-generating software

A version of its new LLaMA 2 language model that is able to generate programming code will pose a stiff challenge to similar proprietary code-generating programs from rivals such as OpenAI, Microsoft, and Google. The open-source program is called Code Llama, and its launch is imminent, according to The Information. (The Information)

OpenAI is testing GPT-4 for content moderation

Using the language model to moderate online content could really help alleviate the mental toll content moderation takes on humans. OpenAI says it’s seen some promising first results, although the tech does not outperform highly trained humans. A lot of big, open questions remain, such as whether the tool can be attuned to different cultures and pick up context and nuance. (OpenAI)

Google is working on an AI assistant that offers life advice

The generative AI tools could function as a life coach, offering up ideas, planning instructions, and tutoring tips. (The New York Times)

Two tech luminaries have quit their jobs to build AI systems inspired by bees

Sakana, a new AI research lab, draws inspiration from the animal kingdom. Founded by two prominent industry researchers and former Googlers, the company plans to make multiple smaller AI models that work together, the idea being that a “swarm” of programs could be as powerful as a single large AI model. (Bloomberg)